Encouraging business growth and transformation will be central to our economic recovery and critical to making Calgary and Alberta the choice for national and international capital investment. While investments in community well-being matter, corporate tax critically impacts our ability to compete and grow, both here in Alberta and around the world.

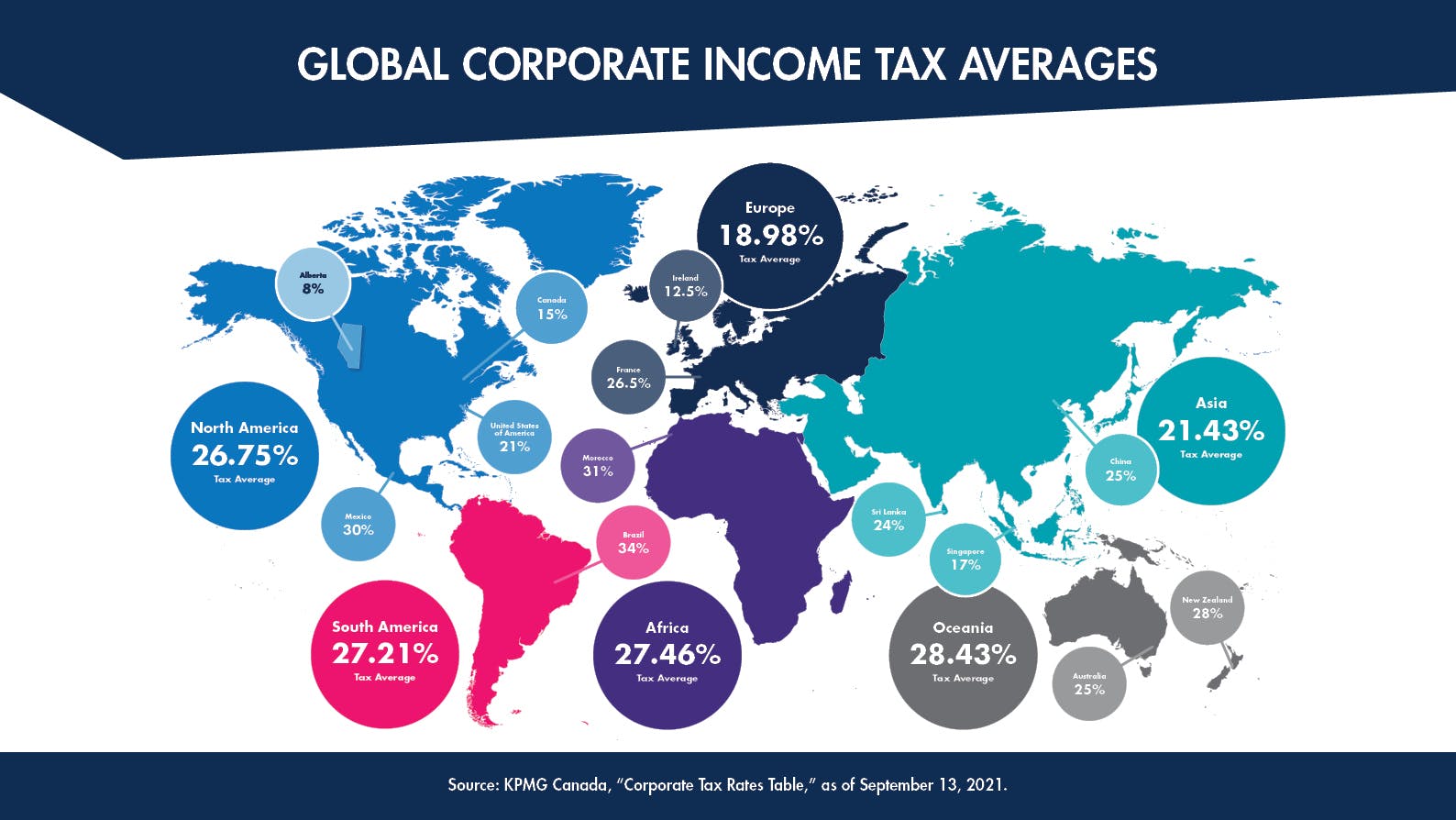

In Alberta, the corporate income tax rate has been the subject of debate over the past few years. In 2015, the provincial government introduced a plan to raise the corporate income tax rate from 10 per cent to 12 per cent. After the 2019 election, Premier Jason Kenney put in place a series of legislative changes that reduced the provincial corporate income tax rate to its current level of eight per cent. Federally, Canada has a net tax rate of 15 per cent as of 2019.

As we increasingly compete in a global market, we need to ensure that corporate taxes enhance competition for business. The globalization of our economy, particularly as the pandemic sped up digitization and changed the way we work, means the current global tax system requires an overhaul. Businesses are increasingly more mobile and willing to move to where they can compete, raising questions about the opportunities and implications of a global corporate tax system.

Where we are today

Around the world, corporate tax systems and rates vary widely. This presents some challenges. Broadly, many globally competitive firms often locate to lower tax jurisdictions. This creates instability for government revenues, with estimates suggesting between $500 billion and $600 billion a year in lost corporate tax revenues for governments around the globe.

A new way forward?

To level the playing field around the world, the Organization for Economic Co-operation and Development (OECD) – an intergovernmental economic organization of 38 member countries – has spearheaded a new initiative to harmonize global corporate tax systems. After years of work, 130 countries, representing more than 90 per cent of the world’s gross domestic product (GDP), have agreed to a new approach. The new global system focuses on two pillars, where a host of changes may occur across countries, with specific impacts to Canada given provincial and federal tax rates:

Next up: moving towards global agreement & why it matters

Earlier this year, Canada decided to adopt these two pillars. With many of our economic competitors also signing on, including the European Union, United Kingdom, United States, Brazil, India, Russia, and China, this stands to be a decision will have implications for Calgary’s business community.