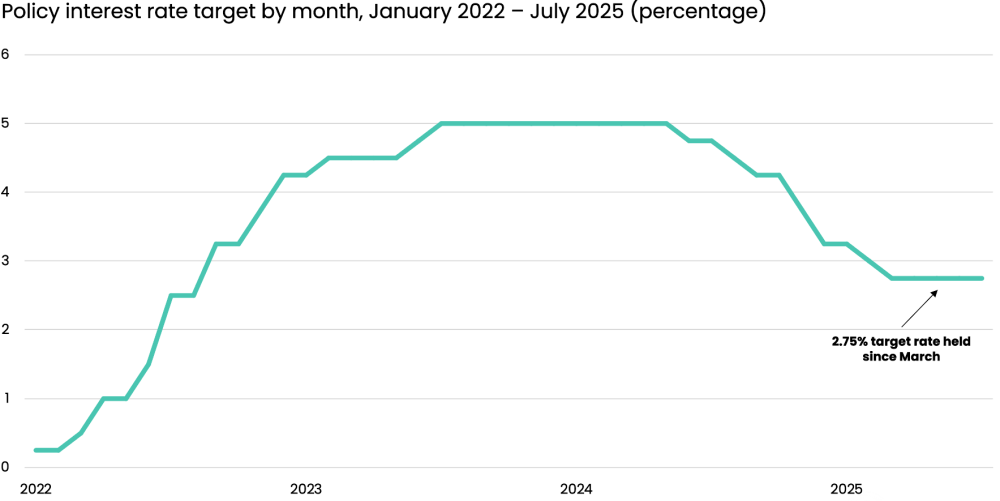

As anticipated, the Bank of Canada maintained its cautious stance on monetary policy this week, maintaining the target interest rate at 2.75%. Here is a closer look at what shaped the decision and what it could mean moving forward:

- Trade tensions: Uncertainty around U.S. tariffs continues to cloud the outlook. With ongoing trade negotiations and the threat of new sector-specific tariffs, the Bank is watching closely to assess how these developments will impact Canadian exports, business investment, employment and consumer spending. Currently, this uncertainty is keeping growth low, and therefore interest rates low.

- Inflation and consumer prices: Inflation, in part attributable to higher prices caused by tariffs, acts as a counterbalancing force to the uncertainty of tariffs. A new trade deal may give indications on how quickly rising costs from tariffs and trade disruptions will be passed on to consumers.

- Across the border: The U.S. is in a similar state. Despite pressure from President Trump to lower interest rates, the U.S. Federal Reserve maintained its rate at 4.3%. The Reserve stated that they want to wait and see how the President’s tariffs impact inflation and the economy before cutting rates.

- Employment: Labour market conditions have weakened in sectors affected by tariffs, such as steel and aluminum. However, unemployment has held up in the rest of the economy, with 83,000 more jobs in June – including 5,500 jobs added in Calgary alone. This marks the largest drop in unemployment across major Canadian cities.

- Looking ahead: While the Bank of Canada typically raises rates to cool inflation and lowers them to stimulate growth, the current hold reflects a delicate balance. With the August 1 trade deadline looming, and the federal government signaling a deal may take longer, the Bank is opting to wait and see.

What this means: While Canada’s economy has demonstrated resilience amid global trade tensions – maintaining stable employment levels and withstanding a modest GDP contraction – the Bank of Canada’s decision to hold the target rate underscores a prudent and cautious approach, prioritizing stability over swift action. Businesses are adapting by absorbing costs rather than passing them on to consumers, but they’re clearly looking for long-term clarity. All eyes now turn to the outcome of trade talks – whether on or after August 1.