While trade talks are ongoing, August 1 landed with increased tariffs rather than a trade deal. As a result, all Canadian imports that are not deemed CUSMA compliant are now subject to a new headline tariff rate of 35 per cent. Various sources have released differing estimates of how many Canadian exports comply with CUSMA rules. This confusion is partially due to the number of businesses that have very recently applied to get certified, making it hard to pin down the most current level of compliance.

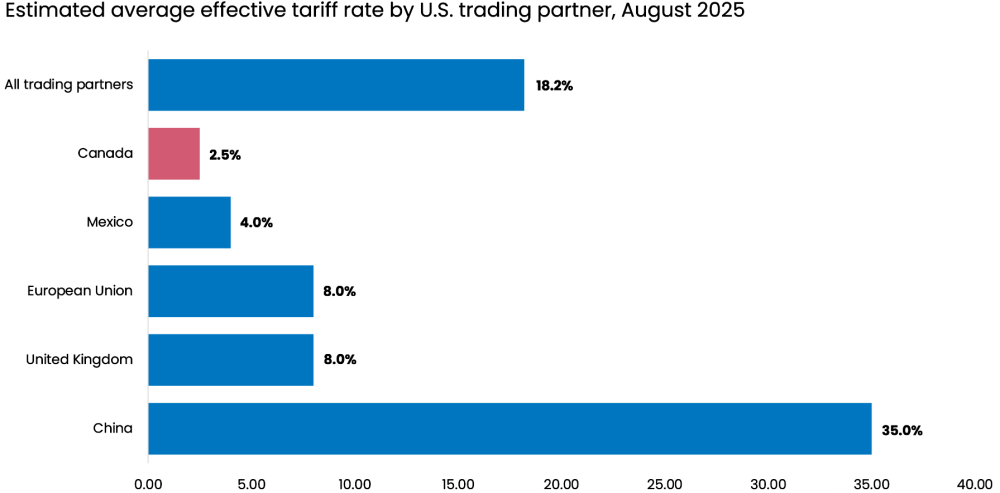

We set out to understand the actual tariffs on Canadian goods when entering the U.S. market given CUSMA – known as effective tariff rates. This refers to the real, average rate paid by exporters across Canada when they ship to the U.S. We also looked at how Canada compares to other U.S. trading partners. Here’s what we found:

- Canada and Mexico currently face the lowest estimated average effective tariffs, at 2.5 and four per cent, respectively.

- China faces the highest effective rate, exceeding 35 per cent, up more than 25 percentage points since January.

- The weighted average of all U.S. tariffs across trading partners is projected to surpass 18 per cent by year-end – the highest level since the 1930s.

- While the full impact of these newly announced tariffs is still unfolding, early signs show a sharp decline in U.S. imports – purchases from China dropped 45 per cent year-over-year in June.

- Estimates of CUSMA-compliant Canadian exports range from 56 to 95 per cent, with the final figure expected to stabilize as the certification process matures.

- Canadian steel and aluminum remain heavily tariffed at 50 per cent, while Canadian lumber is now subject to the new 35 per cent headline tariff.

What this means: Global trade remains unpredictable. Some countries have managed to secure exemptions or strike new deals with the U.S., while others remain in flux. The introduction of the 35 per cent headline tariff on Canadian goods caused concern across industries. But in reality, most Canadian exports seem to be largely protected – thanks to exemptions under the CUSMA agreement. In simple terms, once you factor in the products that are CUSMA compliant, Canadian exporters are paying an average tariff of just 2.5 per cent at the U.S. border. That’s much lower than what countries like China or many in Europe are currently facing and could give Canada a competitive edge if companies start shifting supply chains to avoid higher tariffs elsewhere. That said, the uncertainty is already being felt by Canadian businesses. Many are rethinking hiring plans, adjusting inventories and tweaking pricing – all of which can trickle down to consumers. And with CUSMA up for renegotiation next year, it’s still unclear how long these exemptions will last or what new trade rules might look like for both companies and consumers.